The banking business goes by way of a giant change in the intervening time. Prospects need various things, competitors is hard, shareholders anticipate extra, and there are many new technical advances. Consequently, banks have to alter the best way they do issues digitally. It is not that banks do not wish to change — it is that there are large hurdles in the best way. On this article, we’ll take a detailed have a look at these hurdles.

We’ll begin by trying on the prime three exterior challenges which can be impacting digital transformation in banking.

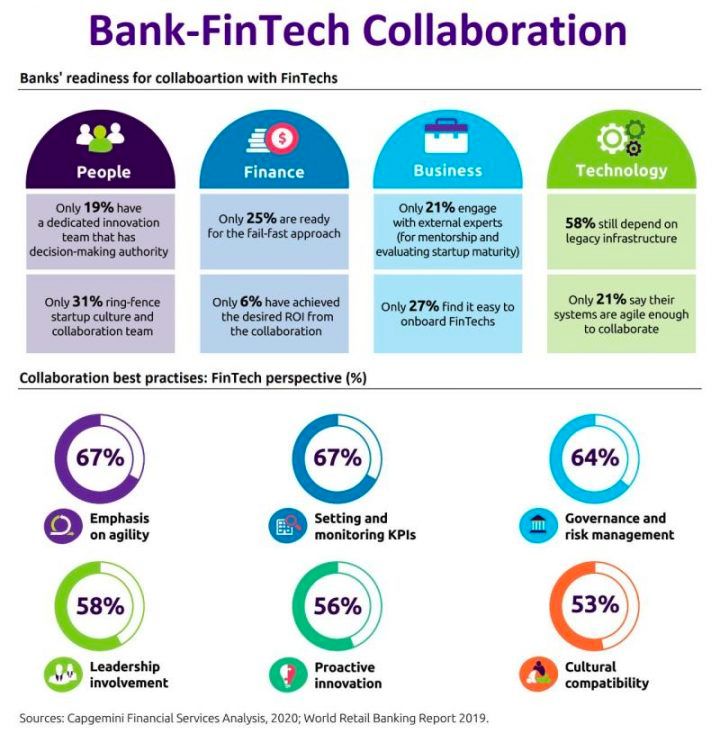

Restricted Capability to Companion with Fintechs

The banking sector historically operates in a silo mentality, which makes collaboration with fintech firms a problem. Navigating it requires understanding the ethos of collaboration, aligning targets, and creating symbiotic partnerships that may drive innovation inside the banking sector.

In lots of instances, banks discover it troublesome to ascertain these partnerships on account of issues about knowledge and monetary safety. Nevertheless, fostering an surroundings of proactive engagement with fintech firms can enormously increase efforts to beat the challenges of digital transformation. Right here’s what a Chief Digital Officer at a U.S. financial institution anonymously shared in a survey:

“After we work with a 3rd celebration, we anticipate to carry them to each normal now we have, even when it’s onerous to us.”

Many banks acknowledge partnering with FinTechs as very important to their success, regardless of the potential dangers, such because the lack of management over new digital companies. An instance is a big financial institution within the Asia-Pacific area adopting Apple Pay on account of buyer demand, regardless of preliminary hesitations.

That mentioned, forming partnerships with FinTechs is just not with out challenges. FinTech firms, given their totally different IT techniques and speedy operations, could not have the capability to combine seamlessly with the advanced techniques of conventional monetary establishments. Barclays Ventures CEO, Ben Daley, acknowledged to Deloitte the position of bigger organizations in serving to FinTech firms navigate these complexities.

Profitable banking-FinTech partnerships should not constructed in a single day however require a shared long-term imaginative and prescient and matching values. Aligning company targets is essential to overcoming these monetary companies business challenges and stopping partnerships from crumbling on account of mismatched expectations.

Rules Constraining Massive-Scale Digital Initiatives

Present regulatory frameworks wrestle to maintain up with the pace of technological innovation. Regulators are being urged to undertake extra agile and principle-based rules that may evolve over time, as an alternative of fastened and probably outdated constructions.

“PSD2 (European Fee Cost Companies Directive 2) is coming into pressure now and it was designed seven, eight years in the past—so you’ll be able to think about the adjustments [in the marketplace] … We want to consider activity-based regulation.” – Ana Botín, Government Chairman of Grupo Santander

Monetary establishments are ruled by a singular algorithm and rules in comparison with start-ups and FinTechs. These rules are sometimes primarily based on the kind of establishment moderately than its particular actions. This poses a problem because the panorama of economic companies is shortly evolving, with companies being repackaged and restructured in new methods.

There are a number of key rules which can be impacting large-scale digital transformation in banks:

- Information Privateness Guidelines. Legal guidelines like Europe’s GDPR and California’s CCPA strictly dictate how banks deal with buyer knowledge, making it tougher to supply personalised digital experiences.

- AML and KYC Guidelines. These rules mandate thorough identification checks and fixed transaction scrutiny to stop unlawful actions, complicating the method of digital onboarding and account setup.

- Capital and Liquidity Necessities. Put up-2008 monetary disaster rules pressure banks to keep up a excessive quantity of money and belongings, proscribing their means to spend money on novel digital platforms and operations.

- Cybersecurity Guidelines. The growing demand for cybersecurity, breach notification, and resilience requires important IT investments from banks, making certain safe digital channels and safety towards cyber threats.

- Legacy Tech Limitations. Many banks depend on outdated techniques and cumbersome infrastructure that hampers the creation of agile new digital platforms. Addressing these legacy techniques requires a significant tech overhaul.

Excessive Investor Expectations Hindering Digitalization Efforts

With hovering investor expectations, banks usually discover themselves underneath stress to ship fast returns. This has the potential to stifle long-term digitalization efforts, that require time, endurance, and a tolerance for danger.

Regional banks comparable to PNC and US Financial institution have scaled again plans for nationwide digital enlargement and new digital-only financial institution manufacturers. Investor enthusiasm has been dampened by financial situations and challenges within the monetary companies business, notably in balancing digital progress with danger administration. Right here’s what an nameless Chief Innovation and Know-how Officer at a UK financial institution mentioned to Deloitte:

“Shareholder expectations actually put a pressure on how a lot cash you’ll be able to put into digital transformation. Everybody is aware of the shoppers’ calls for, however it’s about us creating the monetary capability to spend money on it. We all know what to enhance, simply how will we do it? It’s a must to hit ROE numbers or your share value gained’t carry out.”

Excessive investor expectations have a considerable impact on monetary companies transformation. As stakeholders of the financial institution, traders naturally demand good short-term returns. Nevertheless, these expectations can generally put banks underneath stress, making them cautious of investing in digital transformation – an initiative that often requires time to indicate a return on funding.

Equally, in Q3 2022, Wells Fargo introduced slower-than-expected progress on its digital transformation initiatives. This led to disappointment from traders and analysts, with the financial institution’s inventory value falling over 5%. Wells Fargo needed to cut back a few of its digital priorities to give attention to stabilization and danger/compliance initiatives.

Balancing these expectations whereas investing in long-term digital transformation usually turns into a problem.

Let’s now shift our focus to the highest 3 inside digital banking challenges that hinder the digital transformation initiative inside banks.

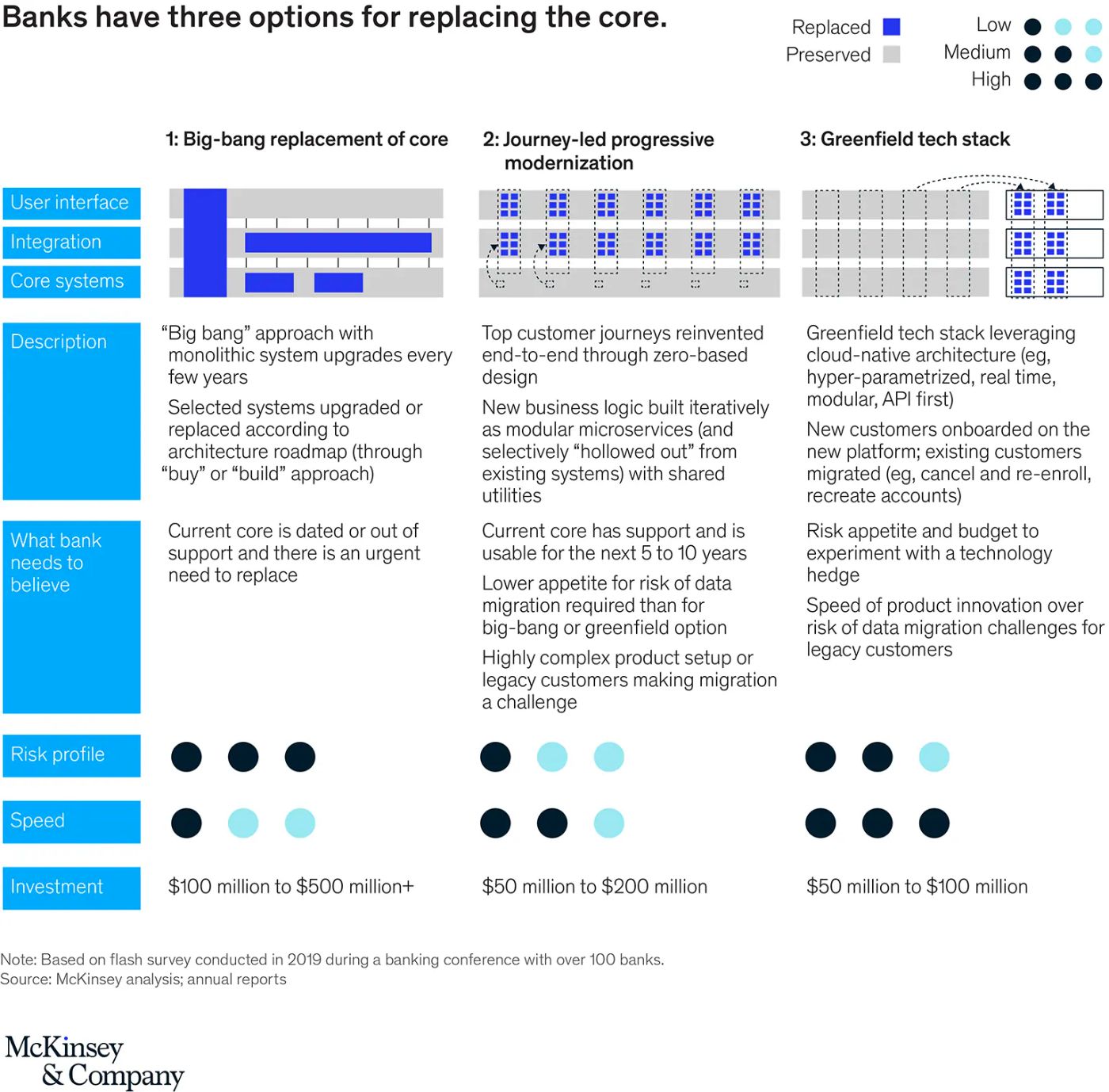

Legacy Programs and Lack of Interoperability

Round 60% of banks are nonetheless depending on legacy techniques. Updating and adjusting previous techniques to work with new digital applied sciences maintain financial institution digital transformation behind. Interoperability points usually stump digital transformation plans.

Wells Fargo suffered a techniques outage in March 2023 that left tens of millions of shoppers unable to entry on-line/cell banking or ATMs for over 24 hours. The financial institution blamed the outage on its reliance on outdated infrastructure that could not deal with an influence shutdown. Equally, Financial institution of America introduced in 2023 that it might delay the launch of its real-time funds platform on account of technical difficulties interfacing the brand new tech with the financial institution’s older techniques.

Despite the fact that many banks see the necessity to transfer away from these previous techniques, sensible adjustments usually pose a problem with out disturbing current work. Furthermore, not all fintech and digital banking options are made to work nicely with legacy techniques, resulting in pricy and dragging customizations.

Banks have to work round previous techniques which were in use for a few years. These legacy techniques usually fail to supply the compatibility wanted for profitable digital banking transformation. Banks then, face the problem of upgrading these techniques with out hindering each day operations. This calls for cautious planning and gradual utility to make sure a clean transition.

Finally, the impediment would not relaxation solely on the expertise itself, however the way it’s built-in into the banks’ present system, procedures, and tradition. Adopting digital banking transformation means creating complete methods that not solely incorporate the expertise but additionally delineate the way it will affect and enhance varied processes inside the financial institution.

Concentrate on Regulatory Modifications, As a substitute of Finance Transformation Initiatives

Usually, inside give attention to complying with regulatory adjustments takes priority over technological transformation, creating extra banking business challenges. Almost 50% of banks are involved about assembly regulatory compliance. Whereas this focus protects banks from potential authorized dangers, it may well divert priceless assets and a spotlight away from much-needed digital transformation.

That is yet one more inside subject of digital transformation challenges. Though regulatory adjustments are essential for controlling danger and enhancing transparency, they will additionally shift the main focus away from digital transformation initiatives. Establishments have to discover a steadiness between assembly regulatory calls for and prioritizing digital initiatives by creating devoted groups or outsourcing regulatory processes.

Digital transformation in banking goes hand in hand with regulatory compliance – an element that usually diverts consideration and assets away from innovation. That is as a result of regulatory adjustments within the banking business are frequent and substantial, imposing a big burden on banks’ inside constructions. The fixed flux of guidelines and norms forces many monetary establishments to focus their efforts on making certain coverage adherence moderately than driving digital innovation. This mindset constricts the tempo of digital transformation, in the end slowing progress inside the monetary companies business.

Danger-conscious Tradition Stopping Innovation

It is no secret embracing the danger concerned with innovation might probably result in large progress. The way forward for finance lies in digitalization, from fintech collaborations to the wide-scale implementation of blockchain applied sciences. Thus, fostering a extra balanced tradition that values each security and innovation is without doubt one of the largest challenges of digital transformation in banking.

Shifting ahead, banks ought to look into integrating their risk-conscious nature with the agility and innovation of fintechs. Incorporating IT for monetary companies must be thought of a key aspect in any banking transformation plan, with methods adjusted to accommodate business rules with out stifling progress.

The trail in direction of extra customer-focused, environment friendly, and safe banking companies could also be full of challenges, however these obstacles are very important stepping stones towards digital transformation in banking. As banks begin to reevaluate their risk-averse attitudes and welcome change, the promise of a completely digital, customer-centric period in finance edges nearer to actuality.

Abstract

Using a banking digital transformation calls for a well-planned, strategic methodology that considers each exterior and inside components. Solely 17% of banks have succeeded in digitally remodeling at scale, which emphasizes the necessity to method it strategically. Overcoming these challenges is hard, however the advantages make it worthwhile.

“The riskiest factor we will do is simply keep the established order.” — Bob Iger